Invoices Issued: Keep a comprehensive record of all invoices you send to clients or customers. These documents should include your business information, invoice numbers, issue dates, detailed descriptions of products or services provided, and the corresponding amounts.

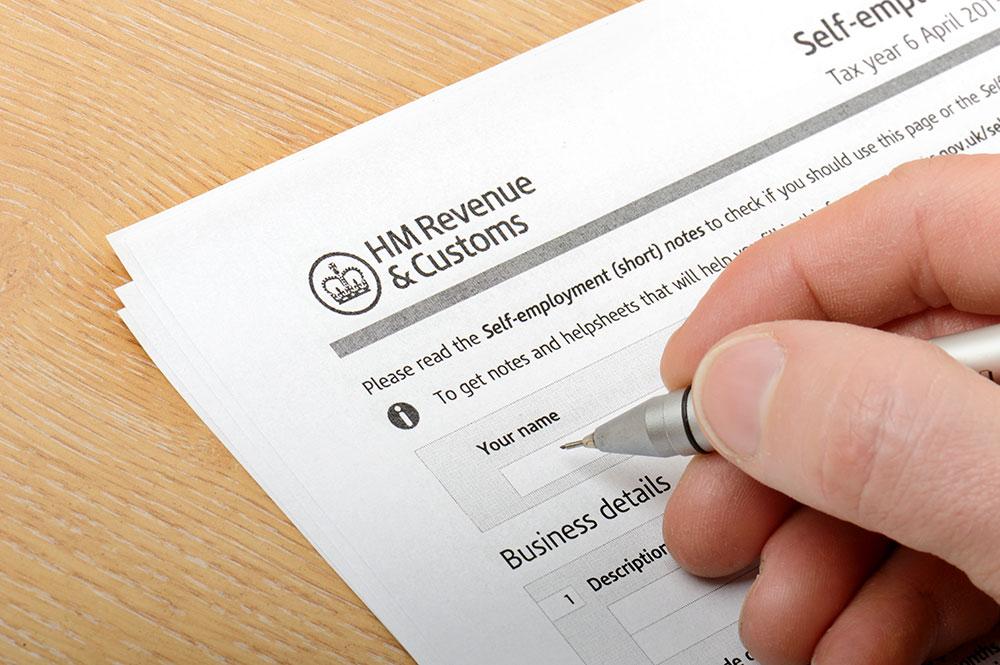

Self-Employed

Accountant for SME’s and Self-Employed Professionals

Are you self-employed and looking for reliable accounting services for self-employed individuals? Taxbee Accountancy specialises in making financial management hassle-free for self-employed professionals. Whether you’re figuring out self-employment tax, filing a self-employed tax return, or needing self-employed tax advice, we’re here to simplify the process.

We understand the complexities of self-employment and income tax, including self-employed pension tax relief and how to maximise your savings. Our team offers tailored solutions, from paying tax to self-employed individuals to providing expert guidance on financial help for self-employed individuals. Let us handle the details so you can focus on growing your business.

Essential Record-Keeping for Self-Employed Individuals

Expense Records: Document every business-related expense meticulously. This encompasses receipts, invoices, and supporting documents for costs like office supplies, rent, utilities, travel, and other expenditures associated with your business operations.

Profit Documentation: Maintain organised records of your income and expenses to facilitate accurate profit calculations. This should encompass sales data, refunds, discounts, and all financial transactions relevant to your business.

Bank Statements: Safeguard copies of your business bank statements to monitor financial inflows and outflows, ensuring a complete and accurate financial trail.

Purchase Receipts and Invoices: Keep a repository of all receipts and invoices associated with your business purchases. These records are vital for tracking expenses and supporting your financial records.

Looking for tax help in the UK? We can connect you with trusted accountants for reliable financial support.

Which Expenses Can You Deduct?

Office Expenses

Travel Costs

Staff Costs

Goods for Sale

Financial Costs

Business Premises Costs

Promotion and Marketing

Capital Expenses

How Taxbee Accountancy Can Assist You?

Our services are designed to meet the unique needs of self-employed individuals. who seek an accountant for the self-employed near me or looking for tax help for the self-employed, we offer comprehensive support. From self-employed accounting to financial assistance for self-employed, our experts ensure accuracy and compliance, saving you time and money.

Taxbee Accountancy also provides the best tax advice for self-employed individuals in the UK.if you need a financial advisor for self-employed guidance or self-employed financial support, our professionals are here to assist every step of the way.

our client's review

We believe our service is second-to-none. We are proactive, tech driven accountants who always go the extra mile, but don't just take our word for it; see what our clients are saying.